A Comprehensive Look at the ADU Market and the Elements of Success

I've been in the ADU space long enough to see what's out there and what's coming. I've seen a handful of implementations from the traditional stick-built to the futuristic space pod and even the Amazon kit-of-parts. I've even written about the origins of the Sears kit-of-parts from years ago when they owned commerce as Amazon does today.

Today, I want to write a quick post about my take on the ADU race today and discuss the ingredients to a winning recipe. I've had the chance to talk to a lot of smart people in tech and successful building developers in California. To start, although each side has a different POV on the ADU marketplace, as a housing product, the ADU is a celebrated vehicle for bringing more housing stock to the Bay Area (and beyond). Although non-confirming types of housing can be controversial, ADUs are widely regarded as a boon for homelessness mitigation, improving affordable housing, and improving homeowner equity. But at the end of the day, the conversations always come down to price per square foot.

In a conventional ADU-building marketplace, the price per square foot will always be what the market will bear.

What is the demand of ADUs in a given region and what is the availability of labor supply for talented contractors?

Over the last year or so, more venture capital funding has been poured into the modular building space, with companies like Habitat, Rent the Backyard, and Veev finding footing in an already crowded market with innovative new solutions like panelized kits, prefab modules, or simply differentiated blueprints.

They aren't the first starry-eyed newcomers to a market already filled to the brim with local general contractors. In fact, the most prolific ADU builder in Bay Area may be prefabADU, a family-run business owned by local general contractor Steve Vallejos who is also very active in local policy and planning conversations with a direct line to several building departments, which effectively control the flow of plan approvals.

This brings me to my first point:

1. Scale

Having a roster of 100s of ADUs under your belt is not enough, it's what's going to get you to the next 100. Will you get there in half the time? Will you get there at half the cost? Will volume grow at the expense of profits or the other way around?

Building stick-built ADUs has its limitations and will never make it past a lifestyle business. This is not a bad thing and some (many) homeowners still crave the handholding that many of these local general contractors offer — someone local and personable to meet you and walk you through the process. I recently tried calling Tesla solar vs. the EnergySage solar marketplace and learned the customer service is night and day. The market for local contractors will always exist, but their market share will slowly decrease over time.

Conventional construction companies include InspiredADUs, Acton ADU, SnapADU, Studio Shed and Prefab ADU. The list goes on in this category with companies that are built with a founding general contractor or family-run business with the familiarity of building, plan check, and crew.

These are the fastest off the starting block, but have the slowest top speed. They have the resources, labor, and know-how to get your ADU done, but they're limited by human capital.

Takeaway: The first and most important ingredient to coveted "Tesla of Homes" is scale. You need a system to modularize your buildings — sections, panels, entire buildings. The only way to do this is through a manufacturing system.

2. Innovation

Innovation in the ADU space is on a spectrum — in the land of manufacturing.

You have the modular prefabs on the conservative side of the innovation spectrum, followed closely by panelized, and then the 3D printed which come in 2 varieties: components and groundbreaking.

Modular prefabs is a growing space as mentioned above, and it doesn't show signs of slowing. Every year, more companies join the space with little-to-no differentiation other than their team, their network, and possibly floor plans. Since architects have all but perfected what can be done with the 800 sf footprint limitation, blueprint differentiation is cheap. The key to a competitive edge then is how fast and how cheaply you can manufacture your buildings (price per square foot).

For companies like Rent the Backyard, Habitat, United Dwelling, and Cottage, they face off in a woeful battle against a pool of local general contractors that own the space, competing on price per square foot, often leaving off the costly truth of non-uniform site preparation costs, perhaps subsidized by venture money.

Then, you have companies that realize the unfortunate state of many ADUs today — a symbol of luxury and disposal income; a tool to help homeowners with equity find ways to house additional family or rent as an income-generating asset.

Companies in this space include Plant Prefab, Modal, Kodasema, and Cover who dive headfirst into luxury and aesthetic. On the ultra-luxury range, you have whole home modular construction, including Connect Homes, BluHomes/Dvele, and Method Homes to name just a few of the dozens.

Takeaway: To survive in the ADU market, you need a differentiator — competing on time and materials is a race to the bottom where the cheapest will succeed. The bell-curve sits at the bottom of the price scale. Yes, some will buy the luxury, but most will sacrifice quality for the bare minimum. Compare your basic ADU to the state of the rental inventory and you're already a step ahead.

3. Invention

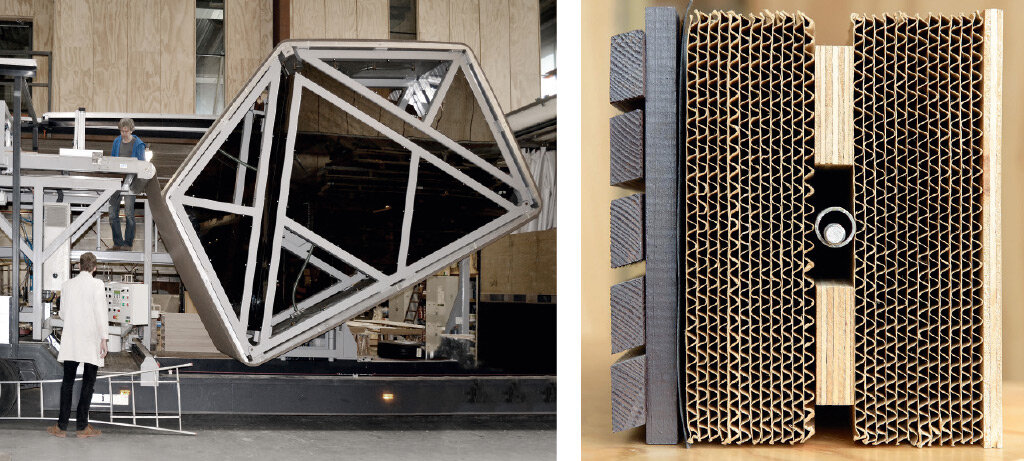

I began writing this section, only to get carried away with excitement. Companies like Icon, WikiHouse, and Mighty Buildings all represent invention on a sliding scale of conservative to groundbreaking.

While some of these companies may never see mass adoption of their technologies, the nature of invention presents opportunities that few companies will see. Their interest often goes beyond progress as an efficiency scale, which solely focuses on the levers of labor and materials that balance cost and time.

On the conservative end, you have Mighty Buildings, an R&D-heavy ADU company that builds homes with 3D printed components, boasting class-leading levels of efficiency (insulation) and near plug-and-play building components like the kitchen, bathroom, and living space. These buildings are still subject to the same limiting factors as all other prefabricated units, which require infrastructure and craning to set and install but present a component-based building process that enables faster implementation across a menu of products with an implementation that doesn't rely on the capability of a single individual.

In the middle, outside the realm of traditional building, you have companies like Fiction Fantasy, WikiHouse, and UBuild, whose component-based construction takes a page out of IKEA's playbook, with easy-to-understand building methodologies and flexible floor plans designed by you, the homeowner. Whether its printable CNC blueprints or cross-sections manufactured from compressed cardboard, each company offers an affordable option, democratized by a building system that puts equity in the hands of the homeowner.

Lastly, there's Icon, a 3D printed, site-built system with advanced construction technology that literally "prints" homes with a portable concrete robot. Their design system makes building affordable housing neighborhoods a reality, officially completing a community of homes in Texas, Mexico, and soon, the Moon?

Takeaway: Invention is hard, but when done right, it combines the bleeding edge of technology with social good to create a product that is celebrated by many for its capability and impact. While these inventive solutions may not lead the charge and own the ADU market, they create a competitive edge that forces us to question what we know as construction and reconsider what might be a better option for our communities in the long term.